The balance record for a company’s bank account compared to the balance recorded in the company books usually do not match for several reasons. For instance, there can be deposits in transit to the bank, bank charges, NSF checks, and outstanding checks.

Bank reconciliations are usually carried out at regular intervals to ensure that the company’s own bookkeeping is accurate and to catch any potential errors that the bank may have made. Although many companies have specialized software to help calculate complicated bank reconciliation statements, many companies perform their own bookkeeping and calculate them by hand, particularly for statements that are not as complex.

Bank Reconciliation Video Tutorial With Examples

Deposits in Transit

Deposits in transit refer to deposits that are recorded in the company’s books but have not arrived at the bank. Therefore the bank’s records will not show them. There is often a delay between the time that the company records its deposits and when the bank receives the cash, due to bank wiring delays or cash deposit delays.

Deposits in transit can be determined by looking at the deposits that have been recorded in the company’s own records compared to the deposits shown on the bank’s records.

NSF Checks

NSF or insufficient fund checks are checks from a customer that bounced because the customer did not have enough funds in their checking account. The check will have been recorded as a deposit in the company’s records, but the bank will not record a corresponding deposit. The bank will usually record the fact that the customer’s check was a NSF check, and the company’s records can be updated with this information.

Outstanding Checks

When a company writes a check, it will record a debit in its cash records, however the bank will not record a debit until the check is cashed by the customer. Outstanding checks can be determined by comparing the debits listed on the company’s cash account compared to the debits listed on the bank account.

Bank Charges

Some banks may charge a monthly fee for the use of their services, and this service charge will show up as a debit on the company’s bank account, but it will not be recorded by the company right away. The bank will clearly show on their records what the service charge was for and the amount, and this debit can be recorded on the company’s records.

Errors

Basic accounting errors can occur at the bank or at the company. The company may accidentally record a sale twice, or the bank may show two charges on a product that was only purchased one time. These errors are slightly more difficult to pinpoint, but after everything else has been eliminated they typically stand out after some careful investigation and comparing debits and credits on each statement. More often it is the company’s records that have an error, since charges and debits are often recorded manually.

Bank Reconciliation Video Example 1

Bank Reconciliation Video Example 2

Bank Reconciliation Written Example 1

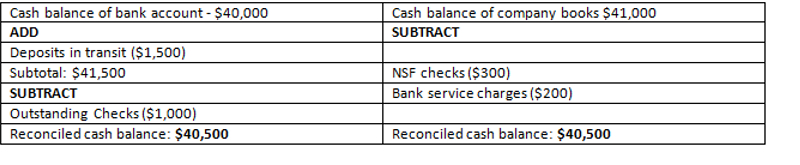

XYZ Corporation shows a cash balance of $41,000 in their own books, while their bank account shows a balance of $40,000.

On the day that the balances were viewed, there was $1,500 of deposits in transit to the bank, $300 in NSF checks that were returned, $200 in bank service charges, and $2,000 in outstanding checks.

To create the reconciliation statement, the balance of the bank account should be added to the deposits in transit which are on the way to the bank, and the outstanding checks which not yet been cashed should be subtracted from the balance.

The company needs to subtract the bank’s service charges from its balance, since it has not recorded the service charge yet, and also subtract the NSF checks which bounced.

The bank reconciliation statement would be prepared as follows:

Bank Reconciliation Statement for XYC Corp.

The reconciled cash balance on the bottom of both sides should be identical after the statement has been prepared.

Bank Reconciliation Written Example 2

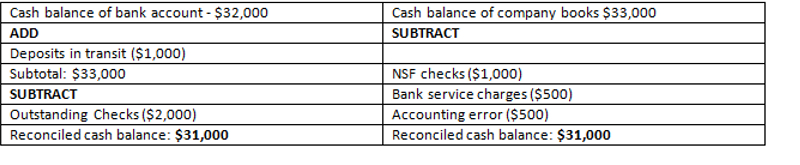

ABC Inc. has recorded a cash balance of $34,000 in their own records while their bank account shows a balance of $32,000 at the end of the year.

On the day the balances were viewed, there were $1,000 in NSF checks, $2,000 in outstanding checks, $1,000 of deposits in transit, $500 in bank service charges, and $500 was recorded erroneously as a credit in the company records.

The bank reconciliation statement would be prepared as follows:

Bank Reconciliation Statement for ABC Inc.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.