Asset management is exactly what it sounds like: the employment of others to manage individual or corporation assets. Assets can be anything that has wealth to it, from cash to buildings to the computer or mobile device you’re using to read these words right now.

Interesting Statistics About Asset Management

The top reason for choosing an asset manager is because of the reputation of their brand or because they represent a premium brand within the industry.

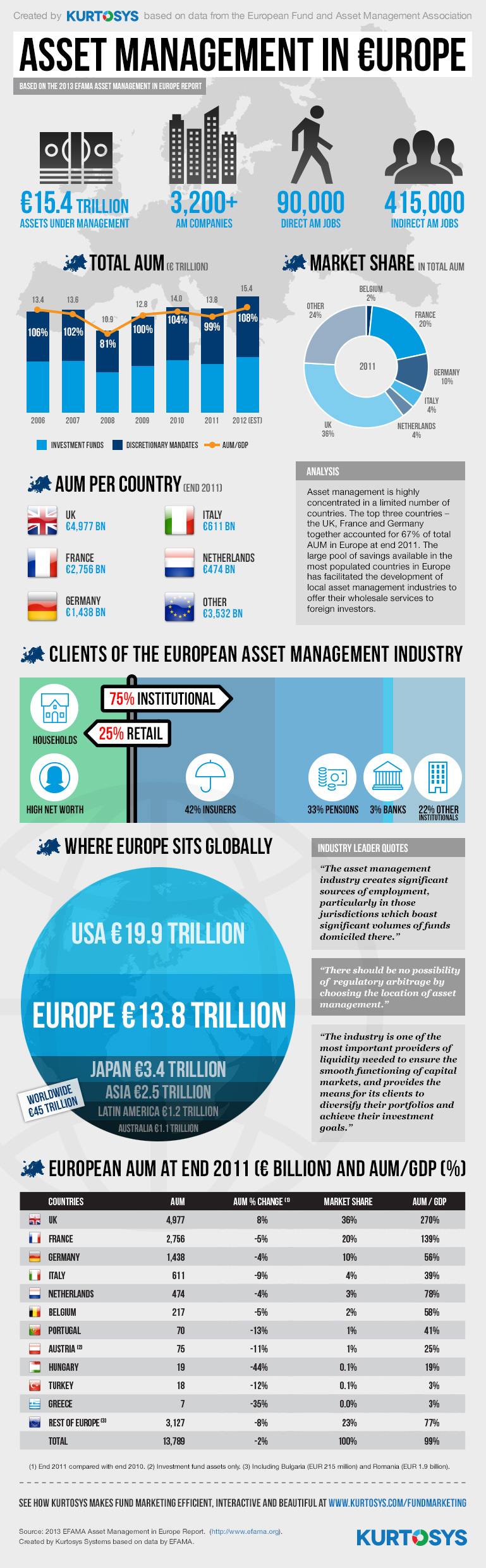

Total revenues that are represented within this industry are in the multiple trillions of dollars. In the European Union alone, more than $13 trillion has been represented by asset managers since 2011. The United Kingdom represents more than one-third of the EU’s assets being managed and almost half of all European assets come in the form of bonds, at 46%.

Three Key Facts About This Industry

1. In a recent survey, 8% of asset managers stated that gender played a major role in their decision to represent a specific client.

2. 75% of the clientele in this industry are institutional.

3. The access to privacy is the least important trait wanted amongst those wishing to have their assets wisely managed.

Takeaway: What is most intriguing about the information here is the fact that nearly 1 in 10 people are judged by an asset manager to be good or bad at what they do simply by appearance. Considering 3 out of every 4 clients for the average asset manager is a company trying to increase their net wealth, it is interesting how there is so much success in this industry that is based on a first impression. Add to that the fact that privacy is the least desired trait in an asset manager and the focus becomes clear: money development.

Other Facts You Need to Know About Asset Management

1. 74% of those who utilize the asset management industry are undergoing some sort of financial transition.

2. 39% of those in a recent survey said that they were satisfied with the changes to their finances that had occurred by using the asset management industry.

3. The biggest barrier to the development of wealth in the asset management industry today is increased regulatory demands. This ranks higher than even having an insufficient budget.

4. 75% believe that there has been no consolidation of firms within the asset management industry in the last 24 months, yet 60% of people expect significant consolidation to occur.

5. Growth in net new money is expected to remain static in all sectors except for traditional mature assets.

6. Singapore is expected to be the top location to attract new assets to managed in the next 2 years.

7. Trust is the biggest factor that an asset manager struggles to understand when meeting with a client.

8. Mutual funds and exchange-traded funds (ETFs) have experienced positive growth. Worldwide regulated funds grew at 9.1 percent CAGR versus 8.6 percent by US mutual funds and ETFs.

Takeaway: Asset management is ultimately about people management. The more you know about someone or an organization, the more you’re likely to be able to effectively manage their assets for them. This means there is a need to build a relationship, but this is evidently not occurring because of the lack of trust understanding. If asset management is an effective industry now, then imagine what it could be like when relationships are emphasized to a greater extent?

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.