Even though businesses lose income due to bad debt, the benefits of offering credit to customers outweigh the disadvantages. A company can substantially increase its revenue by offering credit, and businesses that have good collections policies can reduce their bad debt dramatically. Bad debt is an inherent risk to offering credit, and almost every business expects a percentage of their customers to not pay.

Allowance for Doubtful Accounts Entry Video Tutorial With Examples

The allowance for doubtful accounts entry is an estimate of the accounts receivable of a company that are expected to become bad debts. It is just an estimate and it is used to help the company prepare for the loss of income and better estimate profitability. In some cases customers may pay back some of the estimate or the actual bad debts for the company may end up exceeding the estimate due to various factors. The entry is listed as a deduction on the company’s balance sheet right below the accounts receivable line.

Allowance of Doubtful Accounts Entry Video Example

There are many potential methods of calculating the allowance of doubtful accounts.

There is no one formula for calculating the allowance for doubtful accounts, and there are many criteria that can be used to estimate it. Normally, historical data is used to determine the estimate, and the data can include risk classifications for each customer by assigning them a risk score, the historical percentage of the company’s accounts receivable which were written off previously, and several other methods.

If the estimate ends up being dramatically different from the actual bad debts that the company incurs (either being too high or too low of an estimate), the methodology used to calculate the allowance can be adjusted to be more accurate.

Doubtful Accounts Example

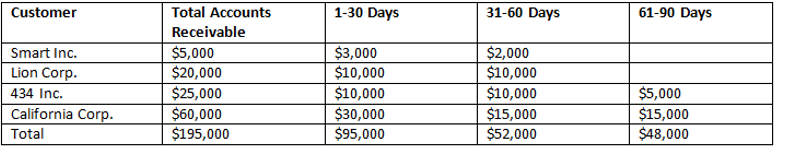

From the following aging of accounts report for ABC Inc., an allowance for doubtful accounts can be calculated. Assume that the company uses historical data and has assigned a risk of non-payment to each past due category.

In this example, ABC Inc. has determined that accounts which are 0-30 days past due have a 96% repayment rate, accounts that are 31-60 days past due have an 86% repayment rate, and accounts that are 61-90 days past due have a 70% repayment rate.

Aging of A/R (accounts receivable) Report for ABC Inc.

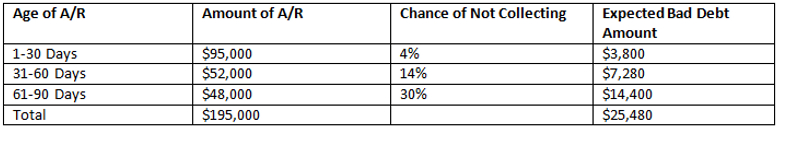

Estimate of Allowance for Doubtful Accounts for ABC Inc.

So, based on the aging of A/R report, and the historical percentages of bad debt from prior customers, ABC Inc. estimates that it will write of $25,480 worth of bad debt from its current A/R total of $195,000.

As the company’s accounts receivable become more and more delinquent, the estimated allowance for doubtful accounts will increase. The company can then create a bad debts expense account. This account is an expense that is charged right when an account receivable becomes delinquent for accurate accounting.

For instance, with the doubtful account estimate of $25,480, ABC Inc. can record a debt of $25,480 to its bad debts expense account. Then the company’s accounts receivable total is credited $25,480, bringing the total down to $169,520. This total is a more accurate estimate of the company’s true accounts receivable, assuming that the allowance was accurately estimated.

The allowance is useful but limited.

The allowance for doubtful accounts can be useful to help a company anticipate its bad debts. It is useful for helping a company abide by the matching principal, and it helps to report the estimated amount of bad debt closer to the time of sale, rather than after a long period of time when the account receivable is finally deemed uncollectible.

It is most useful for financial reporting to determine the profitability of a company, but it is not used for income tax reporting at all, as the IRS requires that a company actually writes off the bad debt before reporting it and not use any kind of estimate to determine bad debt.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.