The aging of accounts receivable method is used to determine bad debts, or debts that are found to be uncollectable based on a set of criteria that will vary from one company to another. Companies with accounts receivable do not always receive cash payments in full due to customers evading payments, bankruptcy, statutes of limitations on collections, and other factors.

Aging of Accounts Receivable Method Video Tutorial With Examples

The method calculates the chance of non-collection for accounts receivable based on the amount of time that they have been outstanding. The method also helps companies identify the customers that are regularly late with their payments so that they can restrict credit to those customers and continue to offer credit to customers who pay on time.

Receivables are normally put into categories that represent payment periods. For instance, a company may have a payment period of 30 days, and its receivables would be classified in an aging schedule where 1 to 30 day old accounts would be in one category, 31 to 60 day accounts would be in the second category, 61 to 90 day old accounts would be in the third category, and so on. Many types of accounting software will automatically arrange the accounts in these categories automatically.

Aging of Accounts Receivable Method Video Example 1

Aging of Accounts Receivable Method Video Example 2

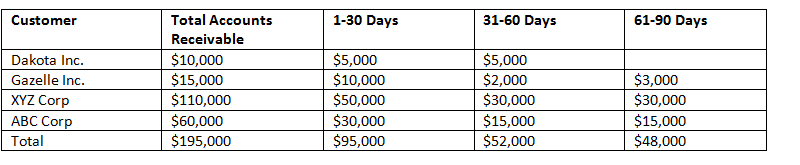

The payment period can normally be customized based on the requirements of the company. For example, one company may prefer to categorize their accounts in 60 day increments their customers need more time to repay their invoices, and others may prefer to categorize their accounts in 15 day increments. Regardless of the increments, the list of accounts receivable can be generated by software or manually and will show past due invoices in a chart similar to the following:

Aging of Accounts Receivable Report

This report can then be used to calculate the allowance for doubtful accounts and help the company estimate their bad debts. The credit department of a company will also be able to use this report to pinpoint the customers that are causing trouble with credit and reduce their credit opportunities, but it is not the only method that should be used to determine credit for a customer.

This report is usually calculated on a regular basis, usually daily, to catch trends in late payments, determine the health of the business, and to spot slowdowns. For example, if a company begins to notice that their accounts receivable are becoming increasingly past due for longer periods of time across the board, it suggests that the customers are possibly experiencing financial difficulties.

When the report is generated on a regular basis, it can be used to send reminder mailings out to customers who have moved from one late period to another. This is helpful for the collections department to ensure that mailings go out on time and that customers are notified. Also, finance charges and interest rates can be calculated with a daily aging of accounts receivable report, and there are many other collections and accounting uses for it.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.