Startup Funding Sources Expand To The Crowd

The ups and downs of startup funding often make the news and throughout 2012 both the good news and the bad news showed some emerging trends in business startup funding. Funding options continued to expand while at the same time some of the big money venture capital firms trimmed their new investments.

Best Investors 2012

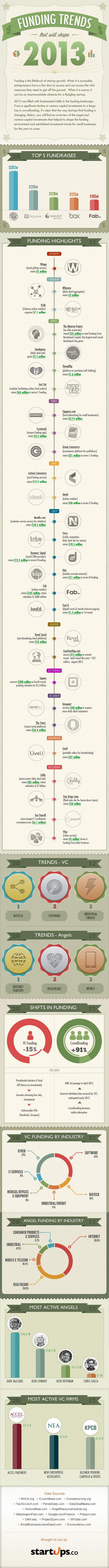

Several prominent angel investors were active in 2012. Dave McClure topped individual investors putting $16.6 million into new startups. As a group 33.6% of angel investor funds were directed toward Internet startups, while 26.5% went to healthcare, and 10.1% was invested in mobile technology and telecommunications.

McClure was one of the investors involved in the infamous meeting in 2010 at the Bin38 wine bar in San Francisco. The meeting of top angel investors about how to compete against other investors and tech incubators for the limited pool of worthy startups led to accusations of collusion and rumors of a review by the FBI.

Role of Venture Firms

Venture Capital Firms were still big players in 2012 led by Accel Partners investing $2.4 billion, while New Enterprise Associates and KCPB each put up $1.8 billion for new ventures. 31% of new VC money went toward software, 14% to biotechnology, and a further 27% of investments covered a diverse range that didn’t fit into any particular category.

A more cautious attitude pervaded the VC industry throughout 2012 with an overall decrease in funding by 15%. The stock market’s hammering of several recent big name IPOs such as Facebook and Groupon may have had a lot to do with VC’s more conservative stance.

Tech incubators are spreading. For profit tech startup incubators and accelerators have been spreading rapidly to the point where an average of one startup a day is launched at a tech incubator program. Y Combinator, established in 2005, was the first and so far the most successful incubator.

A total of 172 Y Combinator startups have been acquired, shut down, or raised capital upon graduating from the program. The companies have a total valuation of $7.8 billion or an average of $45 million per company. The two standouts so far are Dropbox and AirBnB.

Other incubators like Techstars, founded in 2007 and DreamIt Ventures, founded in 2008 have followed suit. The tech incubator model has since spread to Europe and is now spreading rapidly through Asia. Incubators provide small amounts of funding, mentoring, valuable connections and recognition from being in the programs. On average, the programs take a 6% equity stake in the venture.

Crowdfunding

Crowdfunding was the big news in 2012 with startup funds raised through crowdfunding rising 91%. Kickstarter, launched in 2009 as a new way to fund creative ventures in art, design, and publishing has led the way. The success of Kickstarter has led to a wide understanding and growing popularity of crowdfunding. As of October, 2013 Kickstarter had provided more than $812 million in funding toward 49,000 creative projects.

Many other crowdfunding sites have joined Kickstarter to fill various niche markets. Sites like Fundable.com and Crowdfunder.com are aimed at funding small businesses and entrepreneurs. Their programs use various models but are generally grouped as sponsorship, lending, or investment.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.