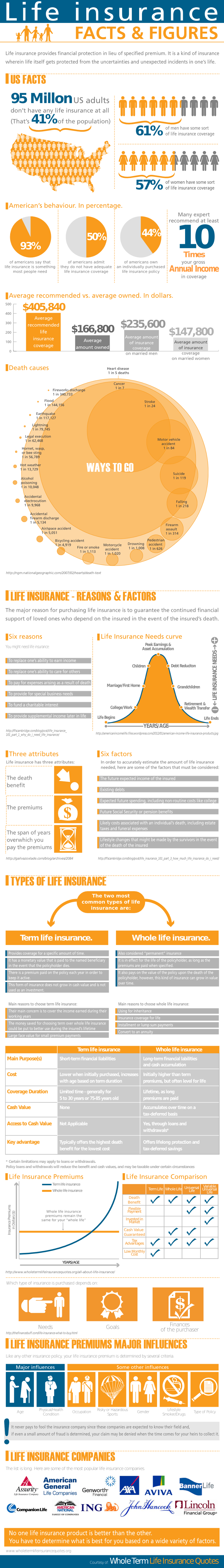

The life insurance industry is broken up between annuities, long term care, disability, and accidental death coverage by group, individual, and credit for debt left behind after your death. Individual life insurance policies account for more than half of the life insurance market at this point in time. Demand for life insurance is primarily dependent on the economy and demographics. Smaller life insurance organizations must focus on specialized services and communities to compete successfully with other major US companies such as AIG and Aetna. The top 50 firms in this industry generate more than 90% of the revenue. A series of life insurance company names are from throughout the United States.

Affinity Financial and Insurance Group

Allstate Insurance

Amalgated Life Insurance

American Exchange Life Insurance Co.

American General Life Insurance Co.

American Heritage Life Insurance Co.

American Income Life Insurance

American Life Insurance Co.

American Pioneer Life Insurance Co.

Amica Mutual Insurance Company

Bluebonnet Life Insurance Co.

British West Insurance

Capital Benefits Corporation

Central United Life Insurance

Great American Life Insurance

Guarantee Trust Life Insurance Company

Guardian Life Insurance

Insure-Rite Inc.

Liberty National Life Insurance Company

Lincoln Heritage Life Insurance

Manhattan Insurance Group

Memorial Insurance Company of America

Monumental Life Insurance Co.

Mutual of America Life Insurance

Nationwide Life Insurance

New Era Life Insurance Company

Northern Life Insurance Co.

Northwestern Mutual Life Insurance Company

Oxford Life Insurance

Pacific Life Insurance Company

Protective Insurance Agency Inc.

Pyramid Life Insurance

Reliable Life Insurance Company

Reliance Standard Life Insurance Co.

Ross Enterprises Insurance Agency LLC

Security National Life Insurance Company

Sentinel Security

Sterling Life Insurance

Trustmark Insurance Co.

Union Labor Life Insurance Co.

Western & Southern Life Insurance Co.

In the United States alone, an estimated 95 million adults have no form of life insurance. An average 61% of men have some form of life insurance coverage to include 57% of women. It is recommended by experts in the industry that life insurance coverage should equal 10 times your gross annual income. While the average amount purchased is over $200,000 the average recommendation is double that rate. The infographic below outlines the most common causes of death and a comparison between average life insurance plans.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.