Appliance come in many different shapes and sizes to accommodate many different household requirements. From washing clothes to preparing food, many of our daily habits rely on this industry for each person to have their basic needs met.

According to data from Hoovers, the US industry is fragmented: the 50 largest companies account for about 40% of industry sales. Small companies are able to compete through product segment specialization and superior levels of customer service.

Many of the trends for the appliance industry involve how energy-savings or water-savings can be experienced while using the product. As government regulations require appliances to become more efficient, both the emerging and developing markets will have several product opportunities from which to choose in the coming years.

Low-Cost Manufacturing and the Appliance Industry

- According to Statista, the consumption of household appliances worldwide is forecast to generate $590 billion annually within the next 5 years.

- The shipments of home appliances around the world is projected to increase from 583 million units to over 700 million units.

- Low-cost manufacturing is driving much of this growth, with China-based Haier Electronics Group leading the way. Other brands that are expected to contribute to the growth of the appliance industry include Electrolux, Bosch and Siemens, Whirlpool, and LG.

- Global net sales of the Haier Electronics group equaled more than $29 billion. Whirlpool achieved revenues of $20.89 billion.

- US household appliance store sales in the past year were $16.6 billion, but in US electronics and appliance stores, sales were $104.01 billion.

- Total unit shipments of major kitchen and laundry appliances in the past year were 64.61 million.

- According to The Freedonia Group, global demand for major household appliances will rise at a 3.0 percent yearly rate through 2019 to 445 million units. Freezers, dishwashers and clothes dryers will be the fastest growing products.

- Hoovers reports that 20% of US industry revenues come from laundry washers and dryers, another 20% comes from refrigerators and freezers, and 20% also comes from ovens, stovetops, and ranges.

As demand for household appliances continues to grow, look for more manufacturers to look for low-cost manufacturing to keep pace with Haier. This will increase the number of available models in each category, giving consumers more opportunities to automate necessary functions of daily life. Premium models with advanced features will offer upper middle class consumers more choices, while entry-level appliances will see continued strength as more households are able to move toward the middle class, some perhaps for the first time. This will also create specific segments of consumer focus, such as energy savings, that the appliance industry can focus upon.

Energy Savings and the Appliance Industry

- Look for Energy Star appliances to continue to dominate the industry, especially with refrigerators, dishwashers, laundry appliances, and HVAC products.

- This is because the heating and cooling process of a home represents nearly 50% of the total energy costs that consumers face each year.

- Energy Star rated appliances are able to deliver an equal or better performance compared to appliances that do not have this rating. Because there is also the potential to limit greenhouse gas emissions as well, appliance owners can help the environment while they help their budget at the same time.

- 30% of the energy that is used in the average building is used either inefficiently or unnecessarily.

- For the average home, according to Class 5 Energy, the most efficient appliance in the kitchen is the microwave, which uses just 1/3 of the wattage of most ovens.

- Energy consumption in the US could be cut by 11% in the next 5 years just by focusing on efficiency measures such as these.

- This means the global market potential for appliances in this category could reach 1.5 billion units within the next 5 years.

- Major household appliances are expected to experience the highest levels of demand, growing at a 5.1% CAGR.

- According to Global Industry Analysts, the APAC region represents the largest and fastest growing appliance market worldwide with a 6.3% CAGR.

- In 2014 alone, American families and businesses have saved $34 billion on utility bills and prevented greenhouse gas emissions equal to the annual electricity use of more than 63 million vehicles according to data released by the US government.

- Americans purchased about 320 million Energy Star certified products in 2014 across more than 70 product categories for a cumulative total of more than 5.2 billion products since 1993.

In the emerging markets around the world, the middle class is continuing to grow as opportunity and wealth are able to grow. This creates more urbanization, but it also creates a higher demand for energy efficient appliances. In mature markets, the need for Energy Star appliances will be even greater as households look to maximize their energy savings. In the emerging markets, look for entry-level appliances to have strong levels of growth, especially in China and India where the movement toward a larger overall middle class continued to build momentum.

Online Sales and the Future of the Appliance Industry

- According to IBIS World, annual growth in online appliance sales was 14.2%, creating revenues of $3 billion despite just 715 businesses being in the market.

- As the housing market and per-capita disposable income continues to recover, expect households to turn to online platforms for deals on their preferred appliances.

- Many major retail chains, including Home Depot and Sears, have already transitioned appliances to an e-commerce platform, sometimes even offering online specific sales for consumers.

- Consumer Reports states that the best deals for appliances are found online, although service tends to be better at either local or regional sellers. A survey of more than 22,000 readers shows that Amazon.com and local independent retailers meet or beat the big boys on selection and leave them in the dust when it comes to good old-fashioned service.

- This means consumers who can purchase appliances online from local or regional sellers can potentially receive the best of both options.

- In 2012, just 16% of appliances were purchased online. In 2013, the last year data is currently available, 25% of appliances were purchased online.

- Look for DIY information to be included more often in online marketing to counter the lack of service an e-commerce platform may be able to provide. This may include video tutorials, comparison scorecards, specific consumer feedback – including product reviews, and toll-free troubleshooting numbers where expert help can be reached.

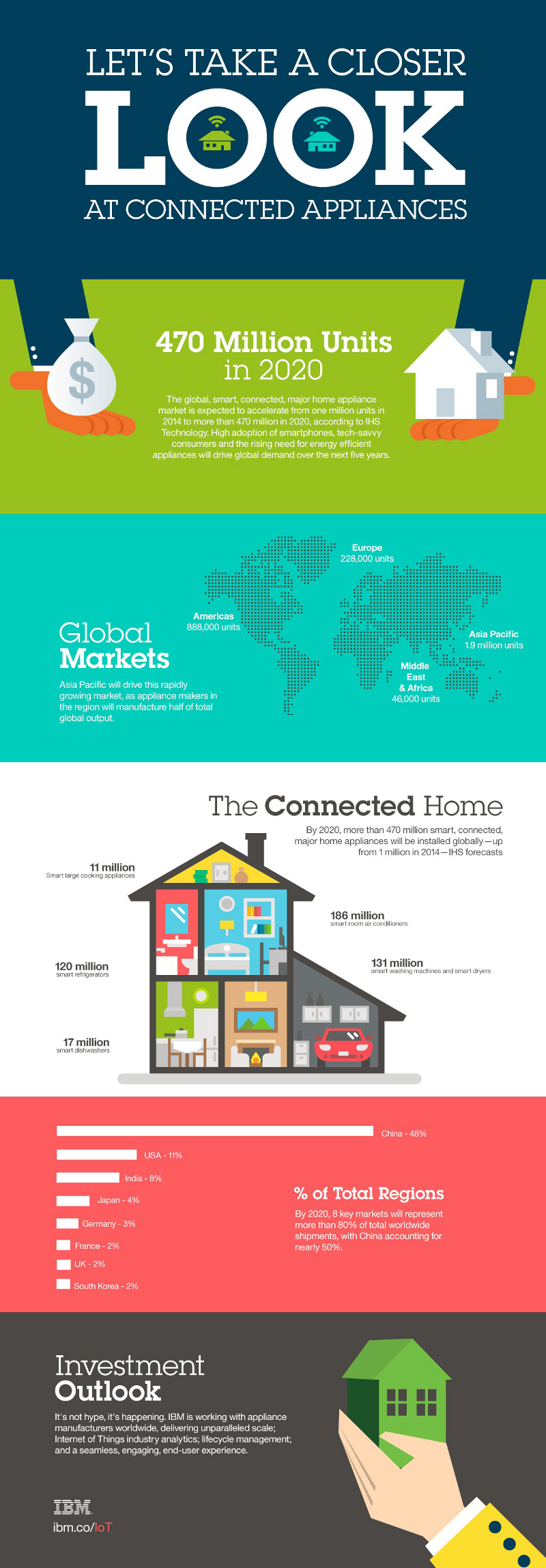

- According to IHS Home Appliances Intelligence Service, the global smart connected white-goods market is forecast to grow at a five-year compound annual growth rate (CAGR) of 134%, from fewer than one million units shipped in 2014 to more than 223 million units by 2020.

As internet saturation continues to grow, especially in the world’s emerging markets, then look for appliance purchases to happen more frequently as households have more money to spend. In high saturation internet markets, watch for shoppers to browse online for deals at major retailers instead of walking into the store to save time and money. CMO reports that online retail sales are expected to reach over $370 billion by 2017, with consumers 25-34 leading the way as 72% of Millennials research and shop online before ever entering a store. As the appliance industry meets this preference, the online sales will continue to grow.

Smart Technologies and the Appliance Industry

- According to Intertek, the sales of connected [smart] appliances has grown to a $6 billion market. In 2010, the market for smart appliances was just $40 million.

- When combined with energy efficiency technologies, the appliances in this category may even qualify for government subsidies to encourage household investment.

- The most popular appliances in this category are typically HVAC or kitchen appliances. 31% of residential electricity consumption comes from the HVAC system, while 27% comes from kitchen appliances.

- Because global energy consumption is expected to triple by 2050, households will focus on smart appliances because this will help them be able to shift peak energy use to off-peak times to help save money.

- Many household appliances spend most of their time in a standy-by mode, which accounts for 13% of total household energy consumption.

The goal of the appliance industry should be fairly simple: provide smart and innovative products that help consumers save time and money. Although connected appliances aren’t necessary for increased energy efficiencies, the ability to share information does help consumers manage their energy footprint more effectively. This allows for greater overall energy savings in all categories, but look for a greater emphasis on the HVAC and kitchen appliances that consume so much energy. The next decade could be quite formative when looking at these appliance industry trends, but only if the industry can keep up with the unique demands of emerging and mature markets simultaneously.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.